In the third blog of the “Around the World ” series focusing on globally distributed storage, streaming, and search, we build a Stock Broker Application.

1. Place Your Bets!

The London Stock Exchange

How did Phileas Fogg make his fortune? Around the World in Eighty Days describes Phileas Fogg in this way:

“Was Phileas Fogg rich? Undoubtedly. But those who knew him best could not imagine how he had made his fortune, and Mr Fogg was the last person to whom to apply for the information.”

I wondered if he had made his fortune on the Stock Market, until I read this:

“Certainly an Englishman, it was more doubtful whether Phileas Fogg was a Londoner. He was never seen on ‘Change, nor at the Bank, nor in the counting-rooms of the “City“‘

Well, even if Fogg wasn’t seen in person at the ‘Change (London Stock Exchange), by 1872 (the year the story is set), it was common to use the telegraph (the internet of the Victorian age, which features regularly in the story) to play the market.

In fact the ability of the telegraph to send and receive information faster than horses/trains/boats etc. had been used for stock market fraud as early as 1814! (The “Great Stock Exchange Fraud of 1814”). Coincidentally (or not?), the famous London Stock Exchange Forgery, also involving the telegraph, also occurred in 1872! Perhaps this explains the ambiguity around the origin of Fogg’s wealth!

What is certain is that Phileas Fogg became the subject of intense betting, and he was even listed on the London Stock Exchange (Chapter V – IN WHICH A NEW SPECIES OF FUNDS, UNKNOWN TO THE MONEYED MEN, APPEARS ON ‘CHANGE):

“Not only the members of the Reform, but the general public, made heavy wagers for or against Phileas Fogg, who was set down in the betting books as if he were a race-horse. Bonds were issued, and made their appearance on ‘Change; “Phileas Fogg bonds” were offered at par or at a premium, and a great business was done in them. But five days after the article in the bulletin of the Geographical Society appeared, the demand began to subside: “Phileas Fogg” declined. They were offered by packages, at first of five, then of ten, until at last nobody would take less than twenty, fifty, a hundred!”

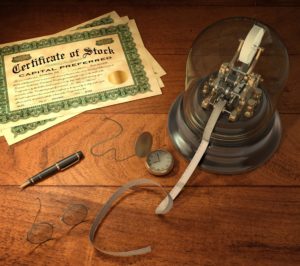

The 1870’s also saw the introduction of a new technological innovation in Stock Trading, the Stock Ticker Machine. Stock tickers were a special type of telegraph receiver designed to print an alphabetical company symbol and the current price of that company’s stock on a paper roll called ticker tape. This enabled stock prices to be communicated closer to real-time across vast distances and revolutionized trading.

Vintage Stock Ticker Machine (Source: Shutterstock)

2. Let’s Build a Stock Broker Application

Fast forward 128 years from 1872 to 2000 and technology looked a bit different. I’m taking inspiration from an earlier project I worked with from 2000-2003 at CSIRO (Australia’s national science research agency) called “StockOnline”. This was an online Stock Broker application designed to benchmark new component-based middleware technologies, including Corba and Enterprise Java (J2EE). The original version simulated traders checking their stock holdings and current stock prices, and then buying and selling stocks, resulting in revised stock holdings. The benchmark could be configured with different workload mixes, and the number of concurrent traders could be scaled up to stress the system under test. Metrics captured included the relative number, throughput, and response time of each of the operations.

Some of the technology innovations that the project was designed to give insights into included:

- the use of application servers to provide easy to manage and scalable container resourcing (yes, containers are at least 20 years old);

- how portable the application was across multiple different vendors application servers (sort of);

- the impact of JVM choice and settings (lots);

- explicit support for component configuration (e.g. wiring components together); and

- deployment into containers, rich container services, and multiple persistence models to manage state and allow database portability (e.g. Container Managed Persistence vs. Bean Managed Persistence).

At the end of the project, we made the StockOnline code and documentation open source, and I recently rediscovered it and made it available on Github. I was surprised to learn that Enterprise Java is still going strong and is now run by the Eclipse Foundation and called “Jakarta EE”. Also interesting is that there is support for persistence to Cassandra.

So let’s move on to the present day.